Forever21, Zara, Topshop and H&M shook up the fashion business by figuring out how to better give consumers what they want, when they want it. They accelerated factory-to-retail floor cycles, zeroed in on au courant merchandise and priced clothes so that even consumers who couldn’t pay for Diane von Furstenberg, Proenza Schouler or Anna Sui pieces scored inexpensive facsimiles.

In the beauty sector, brick-and-mortar retail distribution, seasonal launch schedules and outsourcing have made building equivalent brands difficult. Year-old, direct-to-consumer beauty brand, ColourPop, is proof that it’s possible. “It applies the fast-fashion model to beauty. It creates on-trend products that are of the moment,” said Laura Nelson, Co-Founder of ColourPop’s parent, Seed Beauty, and President and Owner of SPATZ Laboratories.

“With social media and consumer acceptance of buying products online, we see trends coming on quickly. They are intense and also moving out more quickly. The ability to have speed to market to capture those trends is becoming more important.”

The model appears to be working. In a matter of months, ColourPop has become one of the buzziest brands in beauty. In April, it cracked digital marketing insights firm Tribe Dynamics’ La Mode list of the top 10 socially influential color cosmetics brands as measured by earned media value, placing it in the company of Anastasia Beverly Hills, L’Oréal Paris, MAC, NYX, NARS, Maybelline and Urban Decay. Since then, ColourPop has continued to ascend on social media and, in August, Tribe Dynamics found it generated $12.6 million in EMV, besting major brands including NARS, L’Oréal Paris and Maybelline. “All of a sudden, ColourPop has legitimacy beside these top brands,” said Christina Goswiller, Tribe’s head of Strategy and Market Research.

Social media facilitating the spread of ColourPop’s message without TV and magazine ads too steep for a nascent brand, and vertical integration, have been critical to ColourPop’s rise. “We design, develop and manufacture everything [in our facility] north of Los Angeles. Because we have all these resources under one roof, it allows us to be speedy versus having different entities along the way that result in a long developmental lead time,” said John Nelson, Laura Nelson’s brother, Co-Founder of Seed Beauty and Chief Executive Officer of SPATZ Laboratories. “That is very different from traditional brands.”

Seed Beauty birthed ColourPop over the course of three months. The brand debuted with a single shadow available in 31 shades. Today, ColourPop has over 400 stockkeeping units across 10 categories. In just the last few weeks, it released 100 or so sku’s. Products are priced primarily between $5 and $39, a range that makes ColourPop products accessible purchases for young beauty enthusiasts with limited disposable incomes. “We are launching new collections very rapidly,” said Laura. “We are not locked into traditional retail resets. We can map out our future and listen to our customers.”

Free of retail constraints, ColourPop acts swiftly on customer requests and introduces items that capitalize on surging trends. In June, the brand unveiled Ultra Matte Lip in 25 shades and, almost immediately, began receiving feedback that it should branch Ultra Matte Lip into blues, greens and purple. In August, ColourPop expanded the assortment to incorporate those unusual shades. The same month the brand jumped on the strobing trend by putting out two strobing kits.

ColourPop raises the profile of its products on social media by tapping collaborators and milking pop culture memes. To date, the brand has issued about 15 products from collaborations. “The Hunger Games” and “Orphan” actress Isabelle Fuhrman, and actress and singer Rumer Willis, who sported ColourPop as a contestant on “Dancing with the Stars,” have partnered with the brand, but Tribe’s Christina Goswiller pointed out ColourPop’s affiliations with emerging social media stars, notably Kathleen Fuentes, a.k.a. KathleenLights, have provided the most valuable social media content. Other ColourPop collaborators are celebrity makeup artist Jamie Greenberg, and social media influencers going by the handles Coffee Break with Dani, Feral Creature and Ellarie.

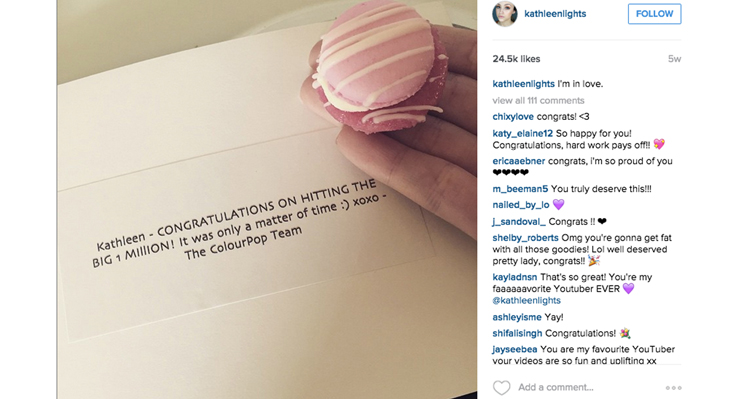

With its social media strategies and its website, Christina said ColourPop has cultivated a “whimsical, fun” brand image. In contrast to brands with slick marketing campaigns, ColourPop excels at connecting emotionally with its collaborators and audience. When Fuentes hit one million subscribers on YouTube – she has closer to 1.5 million now – ColourPop threw her a party and gave her an encouraging congratulatory note she posted on Instagram. In her video announcing the Lumière Lippie Stix she created with ColourPop, Kathleen’s bond with the brand is exhibited in her excitement and gratitude. In a case study on the brand, Tribe Dynamics underscored ColourPop “embodied a young, hip, L.A.-based girl: sharp, smart, and cultured, but easy to connect with and endearing. She is cool, but doesn’t make her friends feel any less cool.”

ColourPop can be a friend to its millennial and Generation Z customers because it speaks to them in their language. It doesn’t take itself too seriously while simultaneously taking concerns its customers have seriously. Product names such as Bae and Pegacorn, which was Taylor Swift’s Halloween costume, demonstrate the brand’s pop culture awareness.In the website FAQ’s, ColourPop jokes it ate a “kale and sunshine smoothie” for breakfast and tags that comment with #thatcalilifestyle. On the more serious side of ColourPop, Tribe Dynamics highlights the brand displays formulas in swatches on three skin tones in recognition of the diversity of its customer base. “The brand’s philosophical stance towards makeup ‘by the people, for the people’ translates into a truly democratic and relatable shopping experience,” wrote the firm.

Unlike brands that rely solely on leveraging trends or linking themselves to a particular look, Christina believes ColourPop’s social media presence won’t ebb. “Its model is sustainable,” she said. “I see it becoming one of the leading brands in the beauty industry because they are establishing very meaningful relationships with influencers who, at the same time, are growing their followings. With the parallel growth of the brand and the influencers, there are ongoing opportunities for product collaborations.”

ColourPop’s success has been a validation of Seed Beauty’s approach. Described by the Nelsons as an incubator, Seed Beauty is charging forward with brands to follow ColourPop. Subsequent brands may be online only, but they could enter brick-and-mortar or be tied to e-commerce operations. “Seed Beauty allows us to try different concepts and models,” said Laura. John added Seed Beauty’s mission “is more relevant today than when we launched 18 months ago because these changes [to the beauty industry] continue to happen. The more we learn from ColourPop, the more we can apply back into development at Seed.”